Getting My Hsmb Advisory Llc To Work

Getting My Hsmb Advisory Llc To Work

Blog Article

Some Known Details About Hsmb Advisory Llc

Table of ContentsGetting The Hsmb Advisory Llc To WorkAll about Hsmb Advisory LlcGetting The Hsmb Advisory Llc To WorkHsmb Advisory Llc Fundamentals Explained

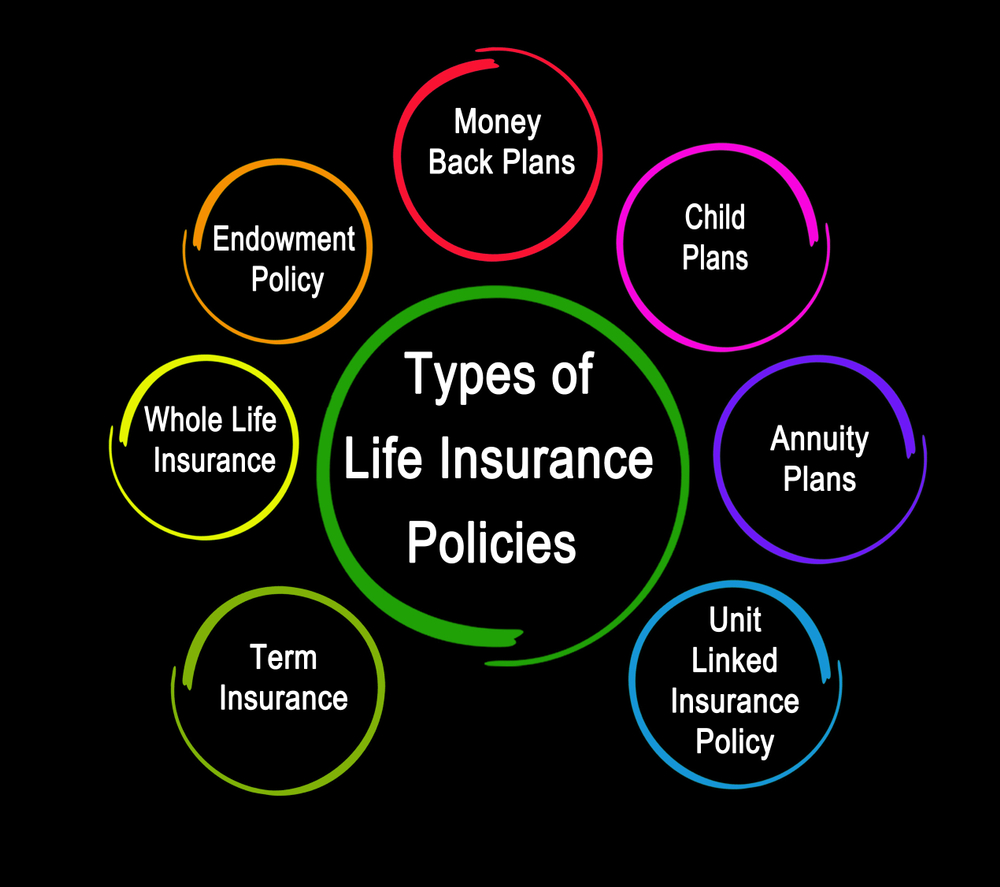

Life insurance policy is specifically essential if your family depends on your salary. Industry professionals suggest a policy that pays 10 times your annual income. When estimating the quantity of life insurance policy you need, consider funeral service expenditures. Then calculate your family's daily living expenditures. These may consist of mortgage repayments, impressive lendings, bank card debt, taxes, day care, and future college prices.Bureau of Labor Statistics, both partners functioned and brought in earnings in 48. They would be most likely to experience economic challenge as a result of one of their wage earners' fatalities., or private insurance policy you acquire for yourself and your family by speaking to health and wellness insurance firms straight or going via a wellness insurance coverage agent.

2% of the American population was without insurance policy protection in 2021, the Centers for Disease Control (CDC) reported in its National Center for Health And Wellness Stats. More than 60% obtained their protection with a company or in the private insurance coverage industry while the rest were covered by government-subsidized programs consisting of Medicare and Medicaid, professionals' advantages programs, and the government market developed under the Affordable Care Act.

An Unbiased View of Hsmb Advisory Llc

If your income is low, you may be one of the 80 million Americans who are qualified for Medicaid.

Investopedia/ Jake Shi Long-term handicap insurance coverage supports those that become incapable to function. According to the Social Safety and security Management, one in 4 employees getting in the labor force will certainly become disabled prior to they reach the age of retired life. While wellness insurance policy pays for hospitalization and medical expenses, you are frequently burdened with every one of the expenditures that your income had covered.

This would certainly be the very best option for safeguarding inexpensive handicap protection. If your company does not use lasting coverage, right here are some points to consider before acquiring insurance coverage by yourself: A policy that ensures income substitute is optimum. Lots of policies pay 40% to 70% of your revenue. The expense of impairment insurance is based upon many elements, including age, way of life, and health and wellness.

Prior to you purchase, check out the fine print. Many plans call for a three-month waiting duration prior to the insurance coverage kicks in, provide an optimum of three years' well worth of insurance coverage, and have significant plan exclusions. Despite years of enhancements in automobile security, an estimated 31,785 people died in web traffic accidents on U.S.

Indicators on Hsmb Advisory Llc You Should Know

Comprehensive insurance policy covers theft and damage to your vehicle because of floods, hailstorm, fire, criminal damage, dropping things, and animal strikes. When you finance your car or rent an automobile, this kind of insurance policy is compulsory. Uninsured/underinsured vehicle driver (UM) insurance coverage: If a without insurance or underinsured vehicle driver strikes your vehicle, this protection pays for you and your guest's medical expenses and may also represent lost revenue or make up for discomfort and suffering.

Employer coverage is commonly the finest alternative, yet if that is not available, obtain quotes from a number of providers as several provide discounts if you buy even more than one kind of insurance coverage. (https://www.pageorama.com/?p=hsmbadvisory)

Everything about Hsmb Advisory Llc

In between medical insurance, life insurance policy, disability, obligation, long-lasting, and even laptop insurance policy, the job of covering yourselfand considering the countless opportunities of what can occur in lifecan feel overwhelming. Once you comprehend the fundamentals and make certain you're adequately covered, insurance coverage can enhance financial self-confidence and well-being. Below are the most vital kinds of insurance you need and what they do, plus a pair ideas to stay clear of overinsuring.

Different states have various regulations, however you can anticipate medical insurance (which several people obtain via their company), auto insurance coverage (if you own or drive an automobile), and home owners insurance policy (if you own residential property) to be on the checklist (https://www.goodreads.com/user/show/175903265-hunter-black). Necessary kinds of insurance can transform, so check out the most up to date regulations every so often, specifically before you renew your plans

Report this page